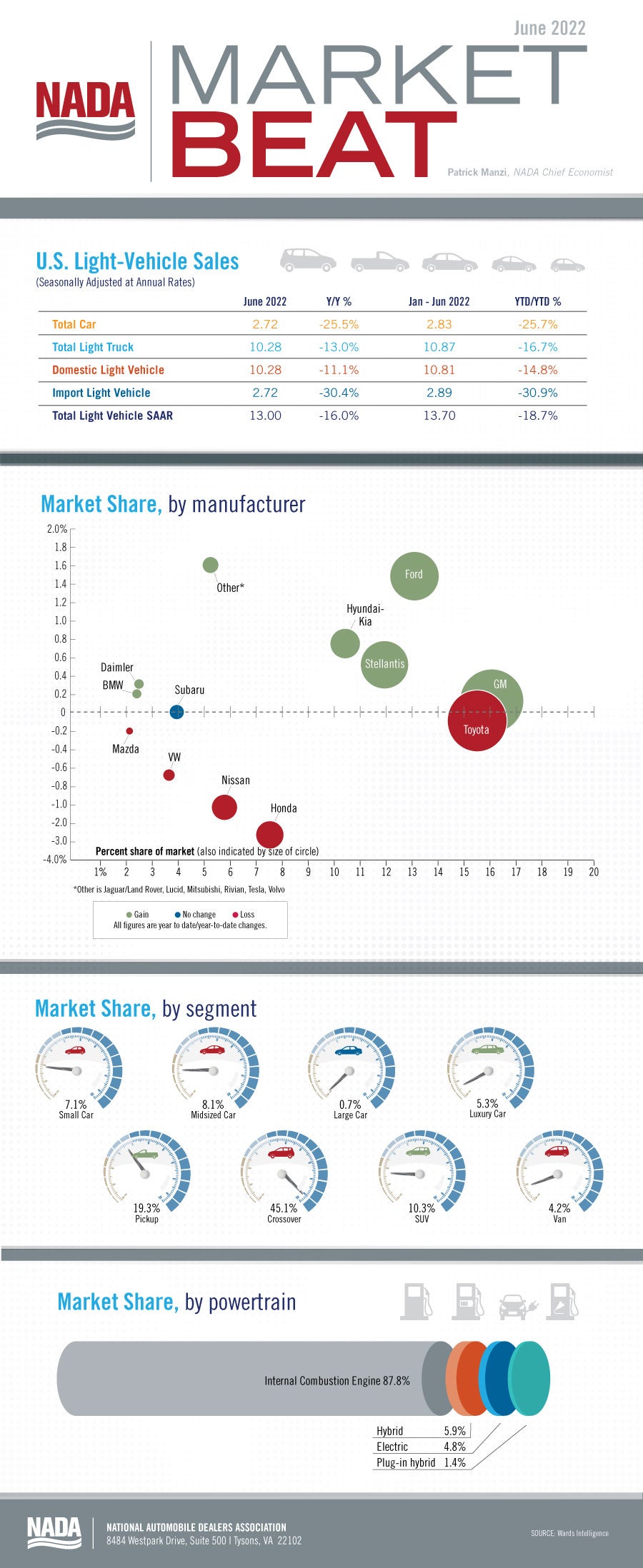

New light-vehicle sales in June 2022 were down year-over-year but up slightly from last month. June 2022’s SAAR of 13 million units was down 16% compared with June 2021 but up 2.3% compared with May 2022. June’s sales brought the second-quarter SAAR to a total of 13.4 million units—a decrease from the first quarter’s 14.1 million. Demand is still outpacing supply, and a lack of inventory continues to be the biggest factor limiting sales. According to Wards Intelligence, inventory at the start of June 2022 was down 25% year-over-year and was less than a third of the pre-pandemic level.

Given the tight inventory situation, manufacturers further reduced incentive spending in June. According to J.D. Power, average incentive spending per unit is expected to total just $930, down 59.4% from June 2021. With OEMs still prioritizing the production of higher-trimmed, more-expensive vehicles and further reducing incentives, the average transaction price is expected to set an all-time record in June. June 2022’s average transaction price, says J.D. Power, will likely total $45,844—an increase of 14.5% from the previous June. Strong demand for used vehicles has helped keep prices for buyers’ trade-ins high all year. One bright spot in a world of rising prices: J.D. Power expects that consumers’ average trade-in equity will total a record-high $10,381. This represents an increase of 49.2% compared with a year ago and the first time average trade-in equity has topped $10,000.

The shortage of microchips continues to limit vehicle production, but it’s not the only hurdle. Numerous other supply chain disruptions have limited OEM production, and many OEMs continue to nearly complete their vehicles and park them while they await chips. Unfortunately, these supply chain issues will continue to limit new-vehicle production, inventory and sales levels for the rest of the year. Additionally, the low interest rate environment of the past few years will shift from a tailwind to a headwind as the Federal Reserve continues to boost interest rates in an effort to reign in inflation. So far this year, the Fed has increased the federal funds rate three times, to a target range of 1.5%-1.75%. More rate increases are a near certainty throughout the remainder of 2022. This means that average interest rates for new- and used-vehicle finance contracts should be back at or above their pre-pandemic levels before the end of the summer. Despite these challenges, demand for new vehicles remains strong, and we expect another great year for America’s franchised dealers.

For more stories like this, bookmark www.NADAheadlines.org as a favorite in the browser of your choice and subscribe to our newsletter here: