New light-vehicle sales in July 2025 were stronger than expected. July 2025’s SAAR totaled 16.4 million units, up 7.1% from June 2025’s SAAR and an increase of 3.7% year-over-year. July’s year-over-year comparison may have been larger, but July 2024’s results included sales that would have occurred in June 2024 were it not for the massive software outage that affected many dealerships across the country.

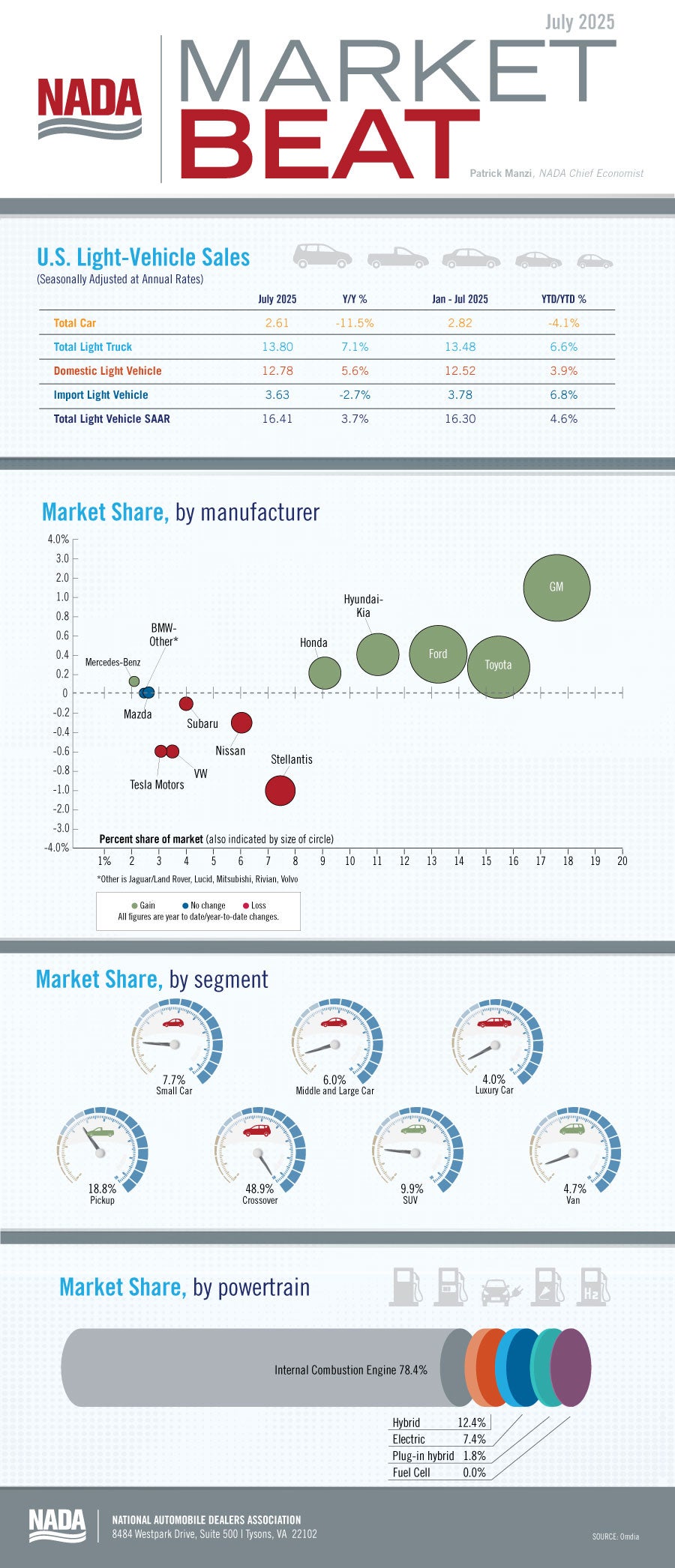

With just a few months left before EV tax credits are set to expire, we expected to see increased activity in the EV space. While BEV sales in July 2025 increased by 22.7% compared to June 2025, sales were flat when compared to July 2024. The same is true for market share year-to-date for BEVs, which totaled 7.4%—also flat year-over year. Meanwhile, plug-in hybrids—some of which are also eligible for the EV tax credit—saw sales and market share decline slightly year-over-year. The most popular alternative-fuel segment continues to be hybrids, which posted a 37.7% year-over-year sales gain in July 2025. Year-to-date, hybrids have also picked up 3 percentage points of market share.

According to J.D. Power, average incentive spending per unit should total $3,051 in July 2025, an increase of $273 compared to June 2025 and up $52 compared to a year ago. As vehicle prices have continued to rise, so too have monthly payments. According to J.D. Power, the average monthly payment on a new-vehicle finance contract is expected to reach $742, up $12 year-over-year. The average new-vehicle finance rate in July 2025 is also expected to be up year-over-year by 30 basis points to 6.54%.

July’s sales results exceeded expectations. Despite this strong performance, one month is not enough to adjust our full-year sales forecast of 15.3 million units. J.D. Power estimates that tariffs are adding $4,275 in cost per vehicle on average. Many OEMs reported significant impacts to their bottom line due to tariffs. It remains to be seen how long OEMs can absorb the price hikes before passing the costs along to consumers. We expect to have more clarity on changing OEM pricing strategies in the fall as 2025 models transition to 2026 models.