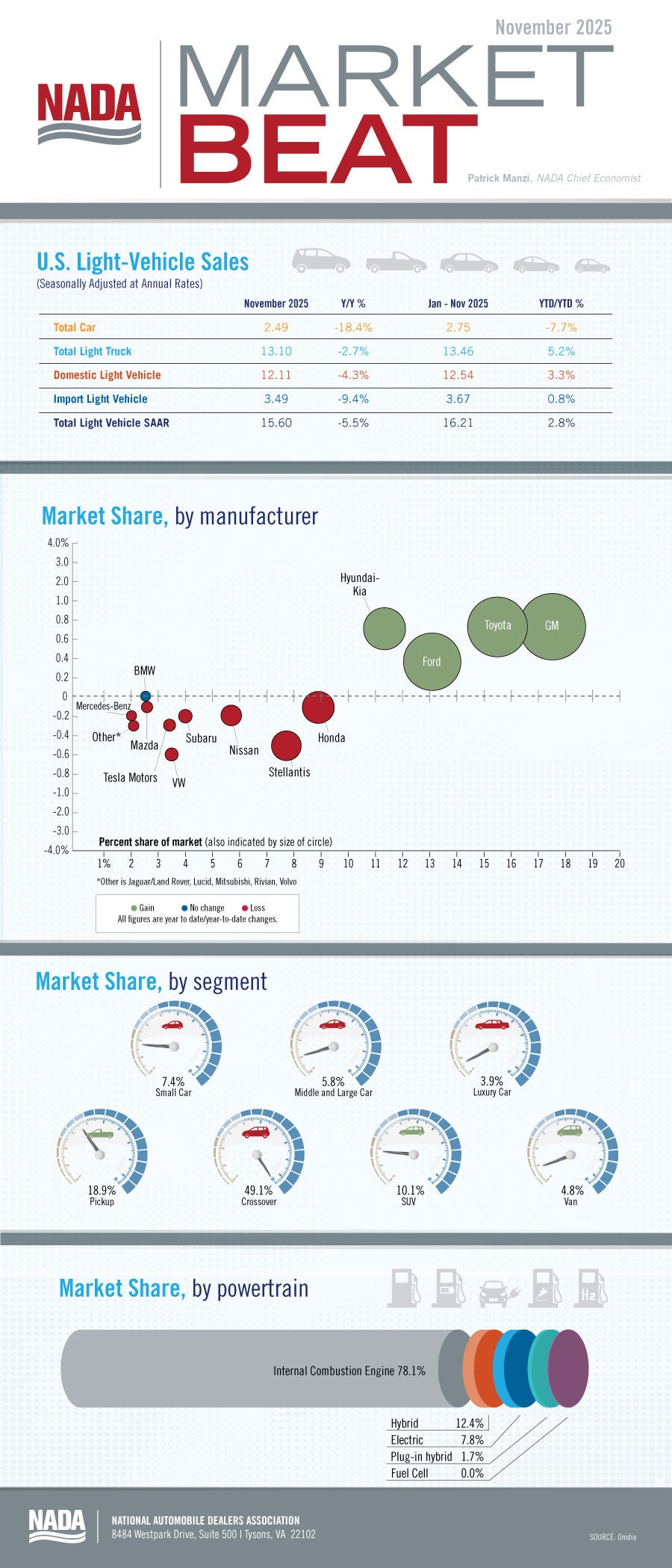

New light-vehicle sales in November 2025 were down year-over-year for the second month in a row. The November 2025 SAAR of 15.6 million units represents a decline of 5.5% compared to November 2024 but was a slight improvement over the October 2025 SAAR of 15.3 million units. The industry is still dealing with the aftermath of significant pull-ahead sales volume that occurred as consumers bought vehicles earlier this year before the expiration of the EV tax credits and before tariff-related price increases took effect.

November was the second month without the EV tax credit, and BEV market share continued to fall—reaching 5.1% of all new vehicles sold, which was less than half the all-time high of 11.3% in September. Discounts remain high on EVs, with J.D. Power estimating that the average EV incentive per unit will total $11,869 in November. Overall average incentive spending per unit is expected to show an increase of $375 from October, reaching a total of $3,211 for November.

J.D. Power estimates that the average new-vehicle retail-transaction price will total $46,029 in November, up $722 year over year. The average new-vehicle monthly payment in November is set to reach $760, a record for the month of November in any previous year. Those with trade-ins will be helped as used-vehicle values have been increasing recently. The industry leased significantly fewer cars three years ago due to the semiconductor microchip shortage, leading to tight supplies of late-model used inventory available today. Rising used-vehicle values should help those consumers with a trade-in vehicle.

Despite the slowdown in sales so far in Q4, we expect new light-vehicle sales to finish the year at 16 million-plus units, given the strong sales performance earlier this year.