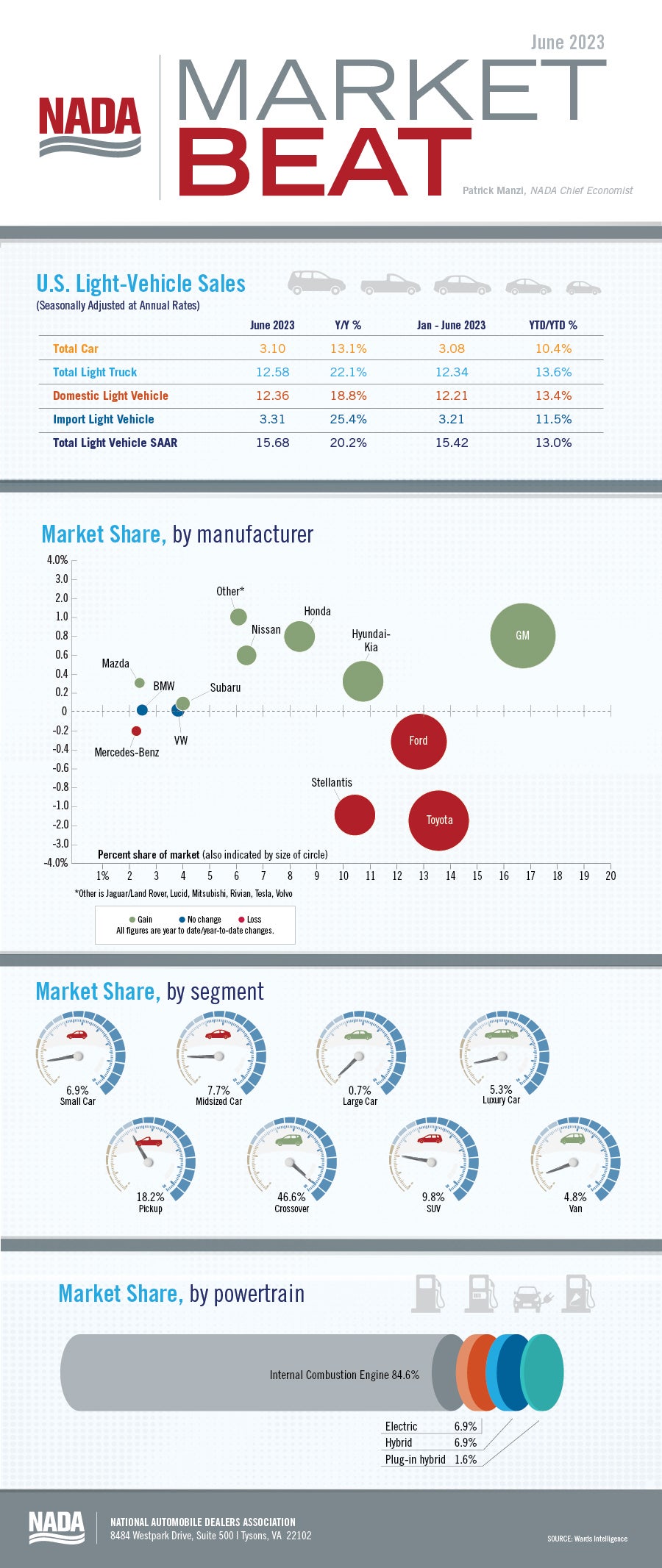

Strong new light-vehicle sales last month helped end the first half of the year on a high note. The June 2023 SAAR totaled 15.7 million units, an increase of 20.2% compared with the June 2022 SAAR. Raw sales volume in June 2023 was 1.37 million units, raising total sales volume for the first half of the year to 7.66 million units—up 13% compared with the first half of 2022. According to Wards intelligence, fleet sales were 18% of June 2023 volume, up from 16% in June 2022. Wards estimates that retail sales increased 7.6% year-over-year the first half of 2023, while fleet sales increased 45% over the same period.

Alternative fuel vehicles gained market share the first half of the year with sales of battery electric vehicles (BEVs), plug-in hybrids and hybrids comprising 15.4% of all new light vehicles sold. BEVs alone represented 6.9% of all new light-vehicle sales, up from 4.9% of sales the first half of 2022. Crossovers— at 46.6% of all new light-vehicles sold during the first half of the year—remained the most popular segment.

Improving new-vehicle availability helped drive the sales increases. New light-vehicle inventory on the ground and in-transit totaled 1.81 million units at the start of June 2023. We expect month-end inventory for June 2023 will increase slightly compared to the beginning of the month. Manufacturer incentive spending has increased incrementally as inventory has improved. According to J.D. Power, average incentive spending per unit is expected to total $1,798 in June 2023, up only slightly compared with May 2023 but a significant 95.9% increase compared with June 2022. J.D. Power also notes that leasing discounts have improved in recent months. In June 2023 leasing should account for 21% of new-vehicle retail sales, an improvement from the low of 16% in September 2022 but still below the pre-pandemic lease penetration of 30% in June 2019.

After a pause at its June meeting, the Fed has signaled it will increase the Fed Funds Rate further in coming months. These higher rates will be a headwind for new-vehicle sales. But there is still pent-up demand from retail and fleet customers, and high used-vehicle values will help consumers with their trade-in values. We expect new light-vehicle sales in the second half of the year to be similar to the first half. As a result, we have increased our overall 2023 forecast to 15.2 million units.

For more stories like this, bookmark www.NADAheadlines.org as a favorite in the browser of your choice and subscribe to our newsletter here: