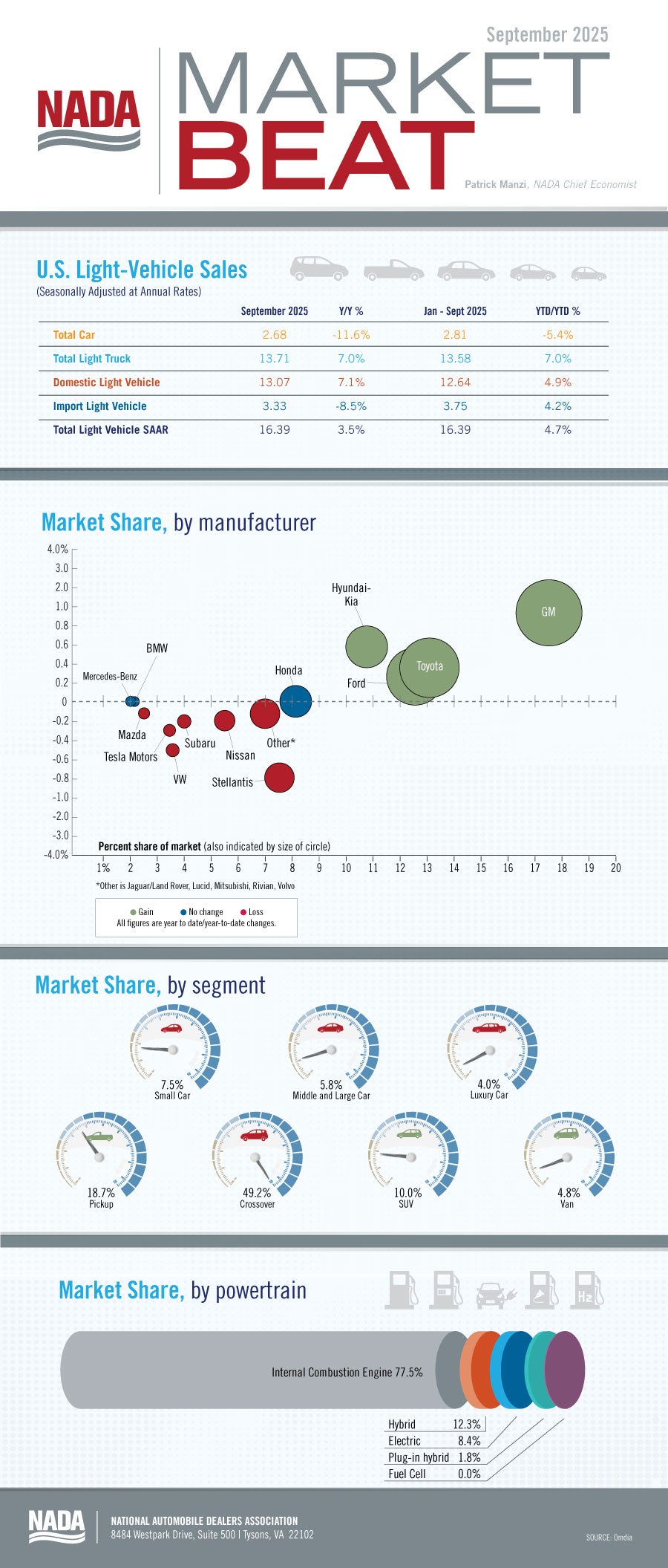

New light-vehicle sales in September 2025 reached a SAAR of 16.4 million units, up 3.5% year over year. September was a solid sales month as many consumers headed to dealer lots before EV tax credits expired on September 30. Battery electric vehicle (BEV) sales hit an all-time high in market share and accounted for 11.8% of all new vehicles sold. This market share was up nearly two percentage points from August 2025, which was also a strong month for BEV sales. Year-to-date, BEV sales accounted for 8.4% of all new vehicles sold, an increase of 0.7 percentage points compared to the same period last year. And for third-quarter 2025, BEV sales increased 24.1% year over year. Plug-in hybrid (PHEV) vehicles, which were also eligible for the tax credits, didn't perform nearly as well as BEVs. PHEV sales in September 2025 accounted for just 1.7% of all new vehicles sold, which is right in line with their year-to-date market share of 1.8%.

The average discount on a new vehicle increased slightly from August to September. According to J.D. Power, average incentive spending per unit should totaled $3,116, up just $24 compared to August 2025. J.D. Power notes that more incentive spending was targeted at EVs. Expressed as a share of the average MSRP, overall incentive spending is expected to be 6.1%, while incentive spending for non-EVs should reach just 4.8%. New light-vehicle inventory on the ground and in-transit totaled 2.65 million units at the end of September 2025, up by 6.2% compared to August 2025 but down 5.9% year-over-year. Looking ahead, we expect inventory levels to end the year slightly below their levels at the end of Q3.

New light-vehicle sales have been solid so far through the third quarter, with a year-to-date SAAR of 16.4 million units—an increase of 4.7% year over year. We believe there has been some significant pull-ahead volume, as consumers rushed to dealer lots earlier in the year before tariffs took effect and in recent months as consumers purchased EVs before the end of tax credits. The big question now: Will volume hold in the final quarter of the year and into next year as 2026 models arrive on dealer lots? We have already seen several OEMs release price increases in the mid-single-digit percentage range for 2026 models, and we are watching closely to see how much—and when—OEMs will pass along tariff-related price increases. Given the strong sales performance so far, we have increased our 2025 sales forecast to 15.9 million units.