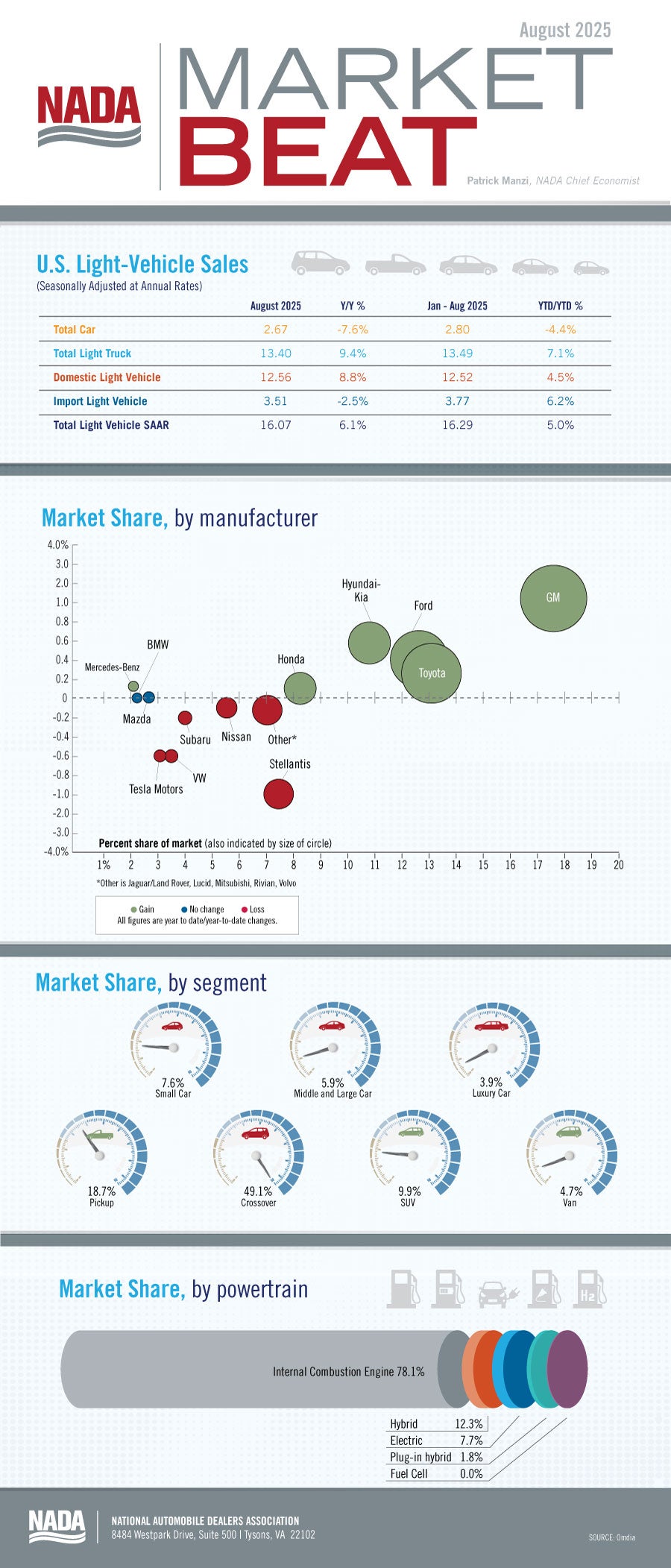

New light-vehicle sales in August 2025 totaled a SAAR of 16.1 million units, an increase of 6.1% year over year. Through the first eight months of the year, new light-vehicle sales are up 5.0% year over year on a SAAR basis. Tariff price increases are expected to appear in MSRP increases as OEMs transition from the 2025 to 2026 model year. August’s sales strength could indicate that some consumers want to secure their vehicle before the price increases kick in.

BEV sales were very strong in August as consumers headed to dealerships to purchase these vehicles before the tax-credit phaseout at the end of September 2025. In August 2025, BEV market share reached 9.7%—up 1.2 percentage points from July 2025 and the highest on record. Year-to-date BEVs have accounted for 7.7% of all new-vehicle sales this year. Looking ahead to September, we expect strong BEV sales for the month but believe BEV sales will cool in the final quarter. Hybrid vehicles also continue to be hot sellers, accounting for 12.3% of all new-vehicle sales this year. Hybrid sales volume was a touch under 1.35 million units through August 2025, an increase of 34.8% year over year.

The August 2025 sales total included the Labor Day weekend. Typically, this is one of the biggest sales weekends of the year, and OEMs respond by increasing incentive spending. According to J.D. Power, OEMs have kept incentive activity relatively restrained due to tariffs. J.D. Power estimates that average incentive spending per unit will total $3,105, down $7 from July 2025 and up by $38 year over year. It remains to be seen how incentive spending will change for the 2026 model year given that many OEMs are expected to increase prices to offset higher tariff costs.