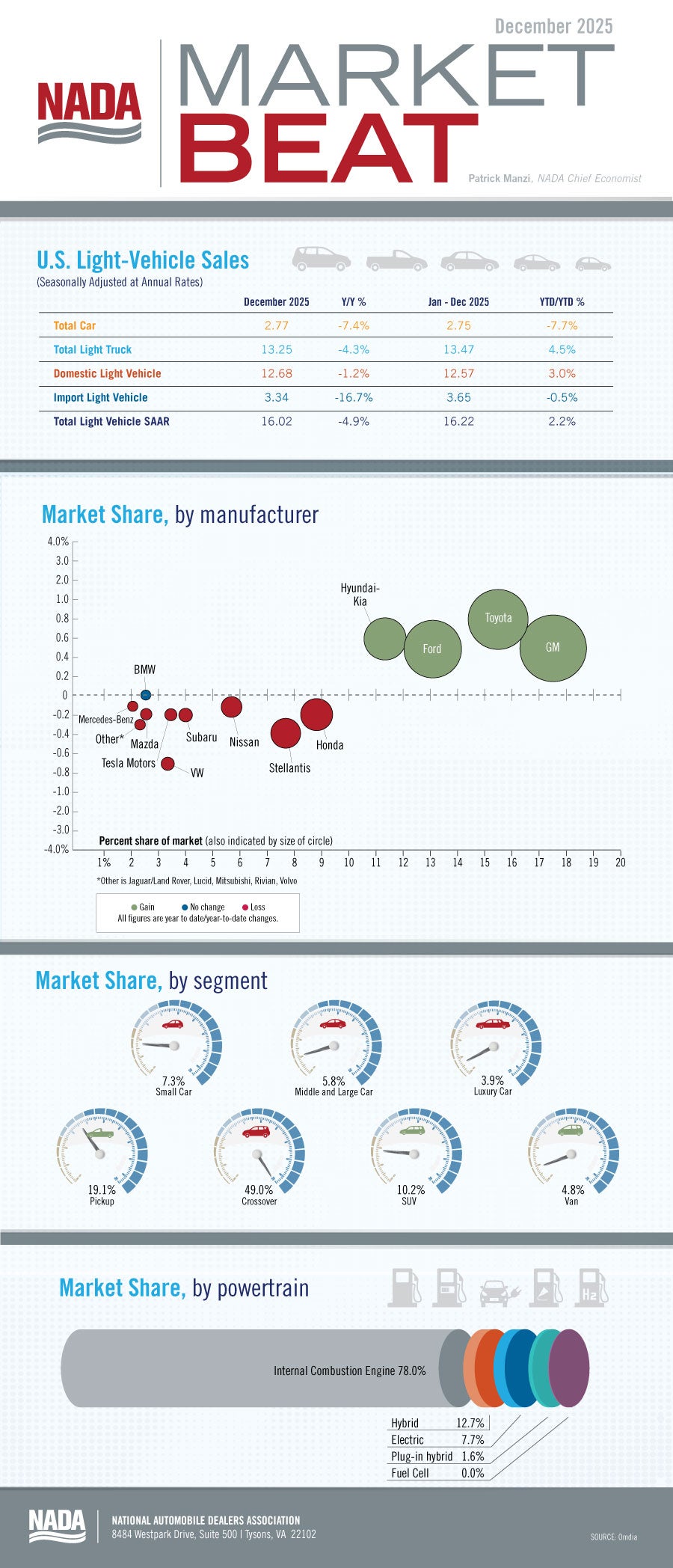

New light-vehicle sales totaled 16.2 million units in 2025, an increase of 2.4% compared to 2024. The US auto industry experienced several shocks last year, including tariffs on imported vehicles and parts as well as the end of the EV tax credits. But tariff announcements induced some consumers to pull ahead purchases in Q2 and buy a vehicle before the tariffs took effect. And the expiration of EV tax credits on September 30 spurred buying activity in Q3, leading to a record-high monthly market share for battery electric vehicles (BEV) of 11.8%.

While BEV market share reached an all-time high in September, sales cooled significantly once tax credits were no longer available. By December, BEV market share fell to 5.9%, a decline of 5.9 percentage points compared to the record set in September. For all of 2025, BEV sales total 1.26 million units, an increase of 1.2% compared to 2024. Despite the increase in BEV sales, BEV market share declined year over year by 0.1 percentage points to 7.7% in 2025.

Meanwhile, sales of conventional hybrid vehicles increased significantly in 2025. Conventional hybrid sales reached 2.05 million units, up 27.6% year over year. Given the changes in the regulatory landscape, we expect BEV sales growth to continue to cool and hybrid sales to increase as OEMs build vehicles with powertrains more in line with current consumer demand.

Despite concerns of significant price increases due to tariffs, average transaction prices increased modestly as most OEMs absorbed much of the additional costs. According to J.D. Power, the average transaction price for a new light vehicle in December 2025 should total $47,104, up 1.5% compared to December 2024. The average monthly payment on a new-vehicle finance contract in December 2025 will likely reach $776, an increase of $22 compared to December 2024. Payment increases were somewhat muted as average interest rates declined slightly during the year. J.D. Power estimates the average interest rate on a new-vehicle finance contract will be 5.84% in December 2025, a decrease of 32 basis points year over year.

Looking ahead to 2026 we are optimistic about new-vehicle sales, though there will certainly be challenges as the industry adjusts to evolving regulatory and trade environments. With the passage of the One Big Beautiful Bill last year, we expect tax season will provide a solid boost to consumer spending and be a tailwind for new-vehicle sales. However, a lackluster labor market may cause some consumers to wait before buying a new vehicle. Still, we expect a solid year for new light-vehicle sales, with a forecast of 16.0 million units in 2026.

- Don't miss Patrick Manzi's Quarterly Economic Report on Dealer Driven, the NADA podcast. Next episode: Mon., Jan. 19.

- Join NADA and Cox economists for an in depth discussion of what to expect from the new light-vehicle market this year at NADA Show 2026 on Live Stage, Thurs., Feb. 5., from 12-12:25pm.