You need a license to drive, a license to surgerize, a license to anesthesize … why don't you need a license to statisticize? I guess because lying with statistics is as American as motherhood and apple pie.

And lying (or twisting the truth) is exactly what some people are doing with the Fed's recently released data regarding auto loan delinquencies.

The headline: Delinquent car loans hit record highs. Seven million people are now 90+ days delinquent on their auto loan.

This has become fodder for people who want to prove that the economy is unhealthy and that countless numbers of people are suffering.

Here's what those people won't tell you: The share of auto loan borrowers who were three months behind on their payments peaked at 5.3% in late 2010. The share is actually lower now—4.5%—because the total number of borrowers has risen so much in the past several years.

The Numbers Don't Add Up

A recent article on the Knowledge@Wharton site titled Is a Subprime Auto Loan Crisis Brewing? contains an interview with Wharton finance professor David Musto and Christopher Peterson, a former advisor to the Consumer Financial Protection Bureau and a law professor at the University of Utah. When asked, "Are we potentially looking at a little bit of a crisis down the road?" Peterson responds:

"We’re talking about seven million individuals that are facing the loss of their vehicle. These are families, so they’re living in households that have an average of 2.5 people per household. So you figure that’s probably roughly about 17 to 18 million people who are affected by this. If you put yourself in the shoes of all these families, it’s very traumatic for a family to go through losing a car. Imagine that you’re the single mom or the dad, and you’ve got to get your kids to soccer practice that week. But you can’t tell them whether or not you’re going to go, because you don’t know if that car’s going to be there or if it’s going to be repossessed."

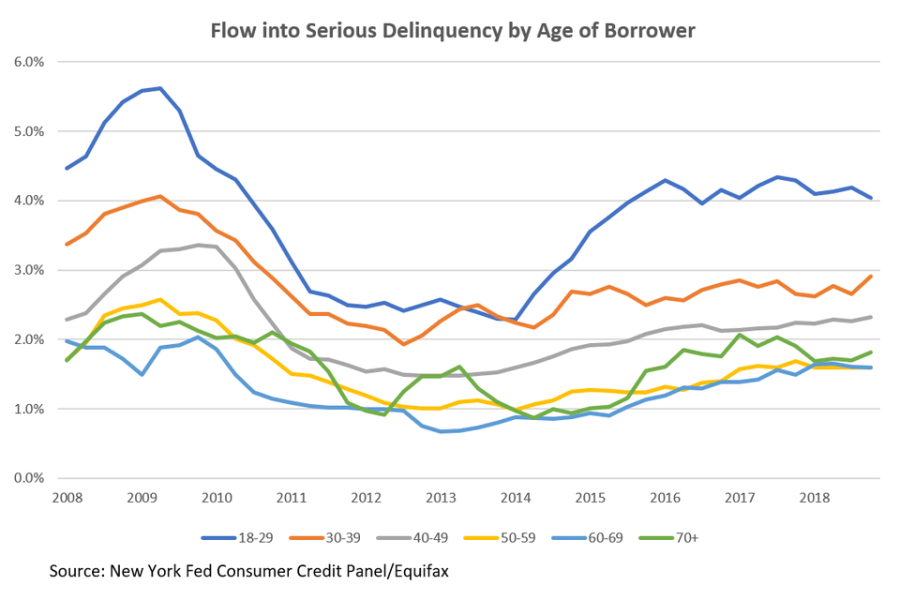

My take: Wrong. Take a look at the chart below. Delinquency rates are far higher among 18- to 29-year-olds than among older consumers. This would also imply that delinquency rates are higher among 18- to 24-year-olds than among those 25- to 29-years-old.

According to Flowing Data, just 1% of 18-year-old men, and 2% of 18-year-old women, are married. Of 25-year-old men and women, 21% and 32%, respectively, are married. And according to the Urban Institute:

"Millennials are having babies at the slowest rate of any generation in American history. Birth rates among women in their twenties dropped by 15 percent between 2007 and 2012."

Which means that there's simply no way that any meaningful number of 18- to 25-year-olds are living in households with 2.5 people, and have children old enough to go to soccer practice!

Among the age groups more likely to have soccer-playing kids, delinquency rates are far lower. More importantly, those delinquency rates have not appreciably increased over the past two years.

And in fact, even among the 18- to 29-year-olds, the run-up in delinquency rates occurred between 2014 and 2016 — and not in the past two years.

Who's to Blame For This? Here's another quote from Mr. Peterson:

"Auto finance companies [are] the lenders that are really driving these high default rates. We have a lot of auto finance companies that I believe are fully aware that they are making loans that have a high probability of defaulting."

My take: Wrong again. While it's true that 50% of auto finance companies' loans go to subprime borrowers (who have higher default rates), overall those lenders account for just 12% of all outstanding auto loan balances, and just 26% of the outstanding loans to subprime borrowers. There's simply no way that these lenders are "driving high default rates" when three-quarters of outstanding sub-prime loans were originated by other lenders.

The second part of the statement makes no sense, either. If the loans have a "high" probability of defaulting, then why are just 6.5% of auto finance company loans 90+ days delinquent?

What's the Real Problem Here?

According to Peterson:

"It’s clear that the public needs to have access to auto finance, so they can buy cars. But they need to buy affordable cars."

My take: I agree with Peterson here, although I would have worded it differently. I would have said "they need to buy cars they can afford."

In any case, the bottom line is this: the absolute number of delinquent auto loan borrowers is not the crisis some would make it out to be. As the Fed itself wrote:

"As of the fourth quarter of 2018, 30% of the $1.27 trillion in outstanding debt was originated to borrowers with credit scores over 760. Meanwhile, the share of total auto loans outstanding that was originated to subprime borrowers fell to 22%. These percentages would suggest that the overall auto loan stock is the highest quality that we have observed since our data began in 2000."

Bolds and italics added for emphasis.

Shevlin is the managing director of fintech research at Cornerstone Advisors and author of the book, "Smarter Bank," the Snarketing blog, and the Moment of Snark on the Breaking Banks podcast.