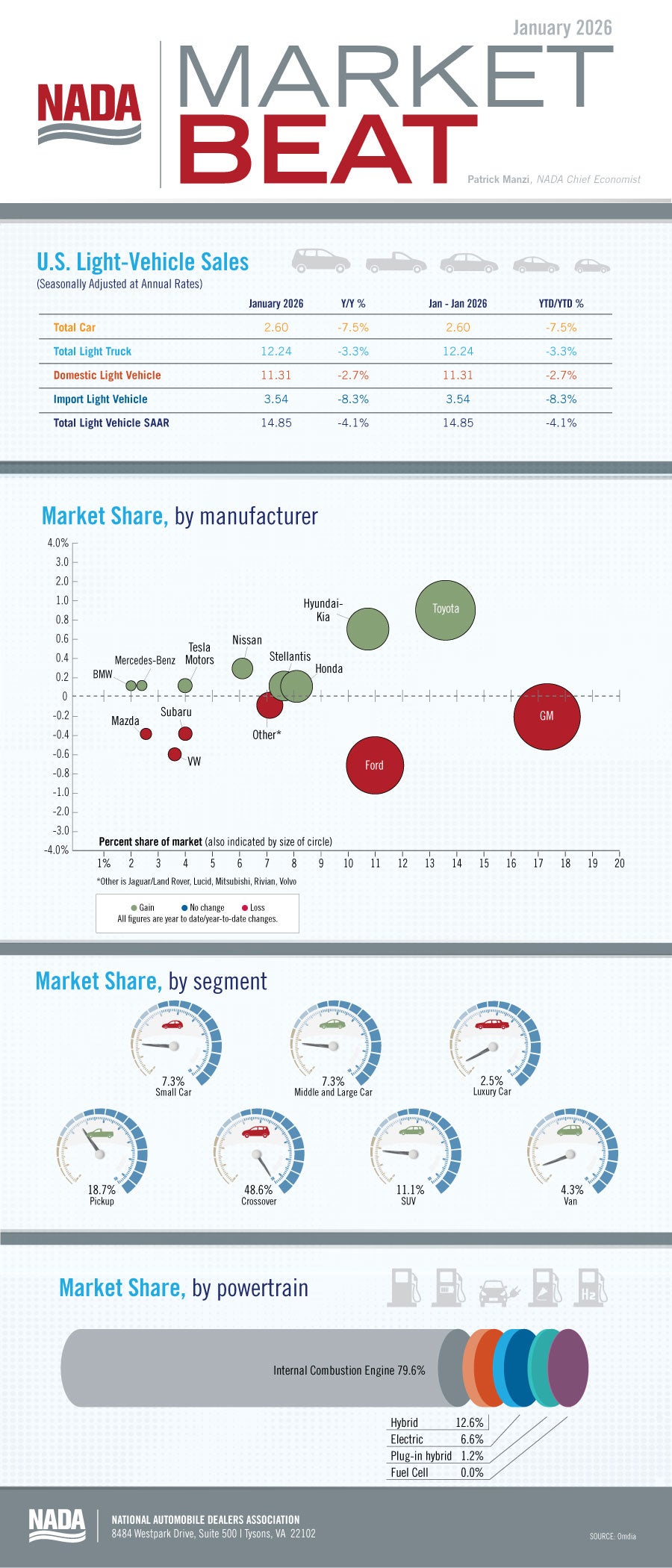

New light-vehicle sales started off 2026 by reaching a January SAAR of 14.9 million units, a 4.1% decline year-over-year and the lowest monthly SAAR since January 2024. Sales in the final two weeks of the month were impacted by severe winter storms, which left many pockets of the country stuck under major snow and ice that dampened store traffic.

J.D. Power estimates that new-vehicle discounts fell in January. Average incentive spending per unit totaled $3,335, a 5.6% increase compared to January 2025, but down 5.5% compared to December 2025. As a share of MSRP, average incentive spending per unit reached 6.6%. Prior to the pandemic, average OEM discounts were closer to 10% of MSRP, so OEMs likely have room to raise discounts to juice demand if they choose.

Battery electric vehicle (BEV) market share in January reached 6.6%, a decline of 1.9 percentage points compared to January 2025. With no federal EV tax credits in 2026, we will be paying close attention to any shifts in BEV sales and market share. Conventional hybrids continued to sell well in January, with market share at 12.6%, an increase of 0.5 percentage points year-over-year.

At the end of January, new light-vehicle inventory on the ground and in transit totaled 2.53 million units, down 9.2% year-over-year and down 2.0% compared to December 2025. We expect new light-vehicle inventory to hover between 2.5 million and 2.6 million units in the first half of the year before rising the rest of the year. Our outlook for new-vehicle sales in 2026 is 16.0 million units.