The effort to preserve dealer-assisted financing continues with NADA and its valued partners. With the introduction of H.R. 1737, Congress is continuing its bipartisan efforts to rescind the Consumer Financial Protection Bureau’s flawed 2013 auto finance guidance.

The House bill, “Reforming CFPB Indirect Auto Financing Guidance Act of 2015,” was introduced by Reps. Frank Guinta (R-N.H.) and Ed Perlmutter (D-Colo.).

Lawmakers on both sides of the aisle recognize that the CFPB’s overreach into our industry would not only harm the intensely competitive indirect auto lending market but, most importantly, would harm consumers by limiting their ability to obtain discounted auto financing from their local dealers.

How?

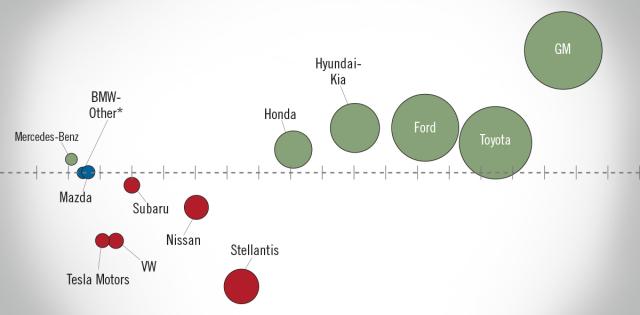

The auto finance market is extremely competitive, with thousands of banks, credit unions and other lenders competing to provide loans—and that competition drives interest rates down. Not only do dealers help customers tap into that market and find great financing options, but dealers can then discount those great rates even further. The financing market may be complicated, but the reality is not: Dealers help consumers save money on auto loans. That’s why 80 percent of new-car buyers chose to finance through their dealership

But the CFPB wants to eliminate this competitive marketplace and rate discounting. It has proposed an inflexible system of price fixing and flat fees that will destroy competition and lead to higher interest rates for everyone.

Instead of protecting consumers, the CFPB’s policy to eliminate discounts in the showroom would prevent consumers from saving millions of dollars each year through dealer-assisted financing.

H.R. 1737 would establish important consumer safeguards. First, it would require the CFPB to study the true impact on consumers before a new guidance is issued. The bill also includes provisions for a public comment period; consulting with the agencies that share jurisdiction over the indirect auto financing market; and disclosing its testing methodologies prior to issuing any future guidance related to indirect auto credit. These are all steps every other federal agency must take before issuing market-altering rules or regulations. There’s no reason the CFPB shouldn’t be held to the same standard.

The National Automobile Dealers Association—and its 16,000 dealer members—applaud Congressional efforts to protect consumer interests. We applaud the leadership of Reps. Guinta and Perlmutter. And we stand behind our financing model and will work hard to make sure it is available for the benefit of customers nationwide.

Be sure to urge your Members of Congress, especially your Democratic representatives, to cosponsor H.R. 1737.

To view the bill text and issue brief, visit www.nada.org/cfpb. For more information, contact NADA’s legislative affairs office at legislative@nada.org.

Bill Fox is 2015 NADA chairman and a multi-franchise dealer in the upstate New York cities of Auburn and Phoenix.