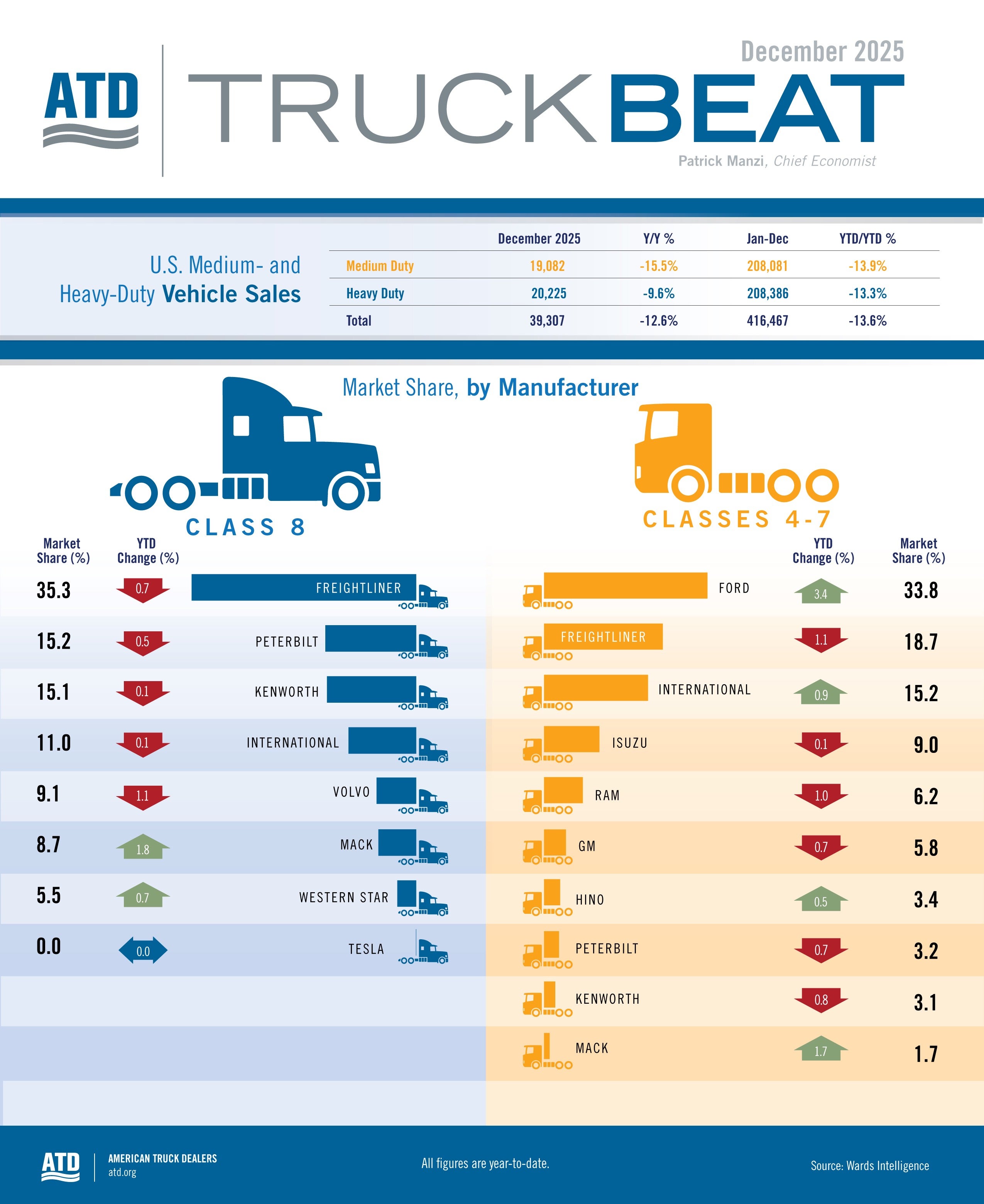

Commercial truck sales declined significantly in 2025. Both medium- and heavy-duty truck sales totaled just over 208,000 units for total commercial truck sales of 416,467 units. Medium-duty sales declined by 13.9% year over year and heavy-duty truck sales declined by 13.3%. The total commercial truck market saw a sales decline of 13.6%.

In December 2025, Class 8 truck sales reached 20,225 units, down 9.6% compared to December 2024 and the sixth consecutive month of year-over-year sales declines. But December wasn’t the slowest-selling month for heavy-duty trucks in Q4. In November 2025, Class 8 sales totaled 12,479 units, down 36.5% year over year and the lowest monthly sales total since May 2020.

Despite lackluster sales in December, there was a bright spot. According to ACT Research, North American Class 8 truck orders hit 42,700, an increase of 118% compared to November 2025. ACT Research did temper this update by noting that when comparing Class 8 truck orders in December 2025 to December 2024, the order increase is just 16%.

The U.S. commercial truck market has been suffering from a freight recession for several years, and freight spot rates have not kept pace with rising costs in the industry. Freight spot rates have been low since collapsing during 2023 and 2024, all while costs to operate a trucking business have skyrocketed. This has caused owner operators and small carriers to operate at a loss or barely break-even. According to Freight Waves, spot rates began to rise during the 2025 holiday season and into 2026. While the recent rise in spot rates isn’t enough to signal a buying spree from owner operators or small fleets, it is an important trend to watch in 2026.

We are also closely following the rollout of EPA27 regulations. According to ACT research, the pending EPA regulations could add as much as $8,000 to the cost of a new heavy-duty truck. And while the increase is less than previously expected, it will come on top of higher truck prices due to tariffs on imported medium- and heavy-duty trucks as well as imported auto parts.

The industry had been expecting significant pre-buys of heavy-duty trucks in model year 2026 before the implementation of EPA27 regulations. But so far that hasn’t materialized. In fact, our outlook for new Class 8 truck sales in 2026 is 171,000 units, a decline of 18% compared to 2025. Our forecast for medium-duty truck sales in 2026 is 236,000 units, an increase of 1% year over year. As we saw the past year, a lot can change in a short time. We may yet see a turnaround in new heavy-duty truck demand toward the middle of the year.