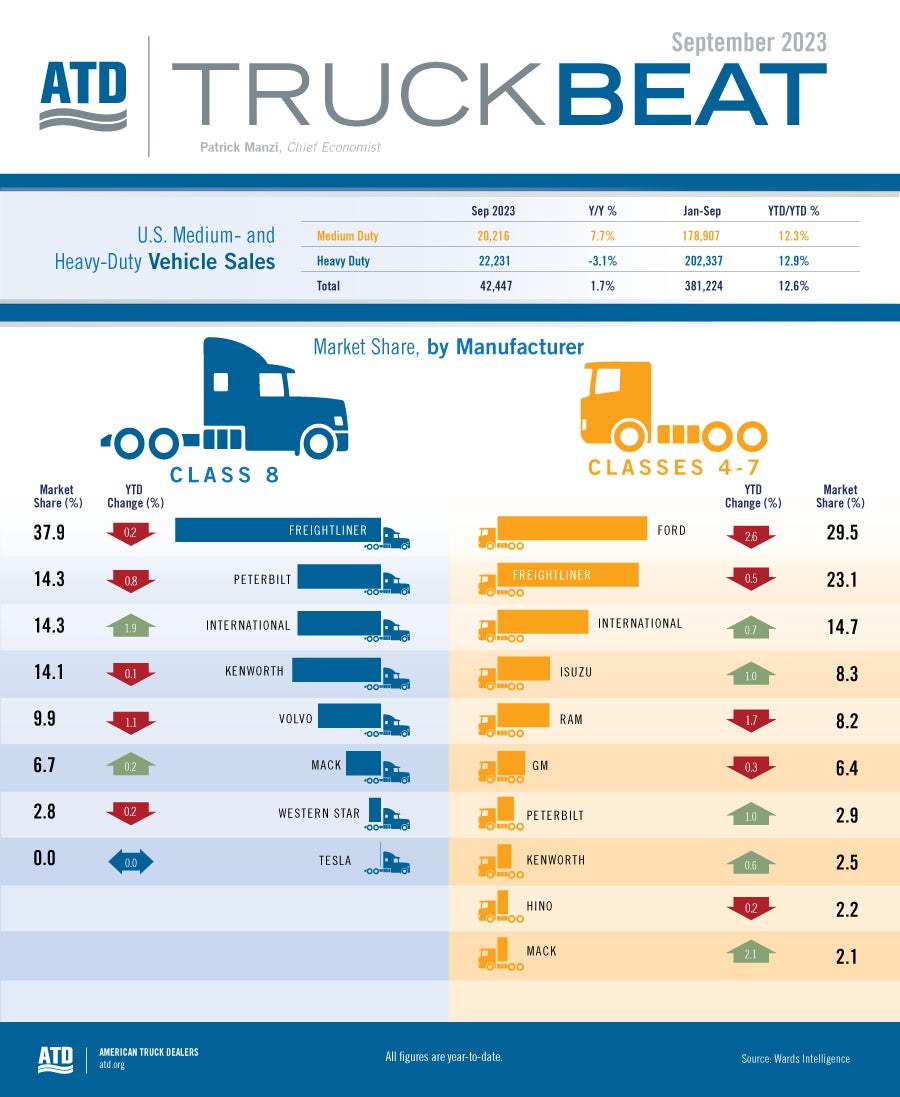

Sales of commercial trucks topped 381,000 units through the end of the third quarter—an increase of 12.6% compared with sales through the third quarter of 2022. Class 8 truck sales in September were down slightly year over year for the second straight month. But through the first nine months of 2023, total heavy-duty truck sales were up by nearly 13% from the same period in 2022. Medium-duty truck sales totaled just under 179,000 units at the end of the third quarter—an increase of 12.3% from the same period last year.

Order boards for model year 2023 filled quickly once they were opened last year and have helped to drive strong sales throughout the year. Subdued orders during the summer allowed OEMs to work through order backlogs that stretched beyond nine months. Backlogs have since declined to a more normal level of around six months. Order boards for model year 2024 have opened and ACT Research estimates that September 2023 Class 8 truck orders totaled 36,800. The month’s orders were significantly below the September record of 53,700, set in September 2022.

With the increased availability of new Class 8 equipment, used Class 8 truck prices have finally come down from the record highs seen over the last two years. According to J.D. Power’s Chriss Visser, Class 8 retail and auction prices have declined significantly from their highs and are at or below 2018 levels. According to ACT Research, the average retail price for a Class 8 truck sold in August 2023 was $64,687, down 25.6% year over year.

Looking ahead through the final quarter of 2023, we don’t expect any surprises that will derail sales. We believe that total commercial truck sales for 2023 will top a half-million units for the first time since 2019, with medium-duty truck sales of some 245,000 and heavy-duty truck sales above 270,000.