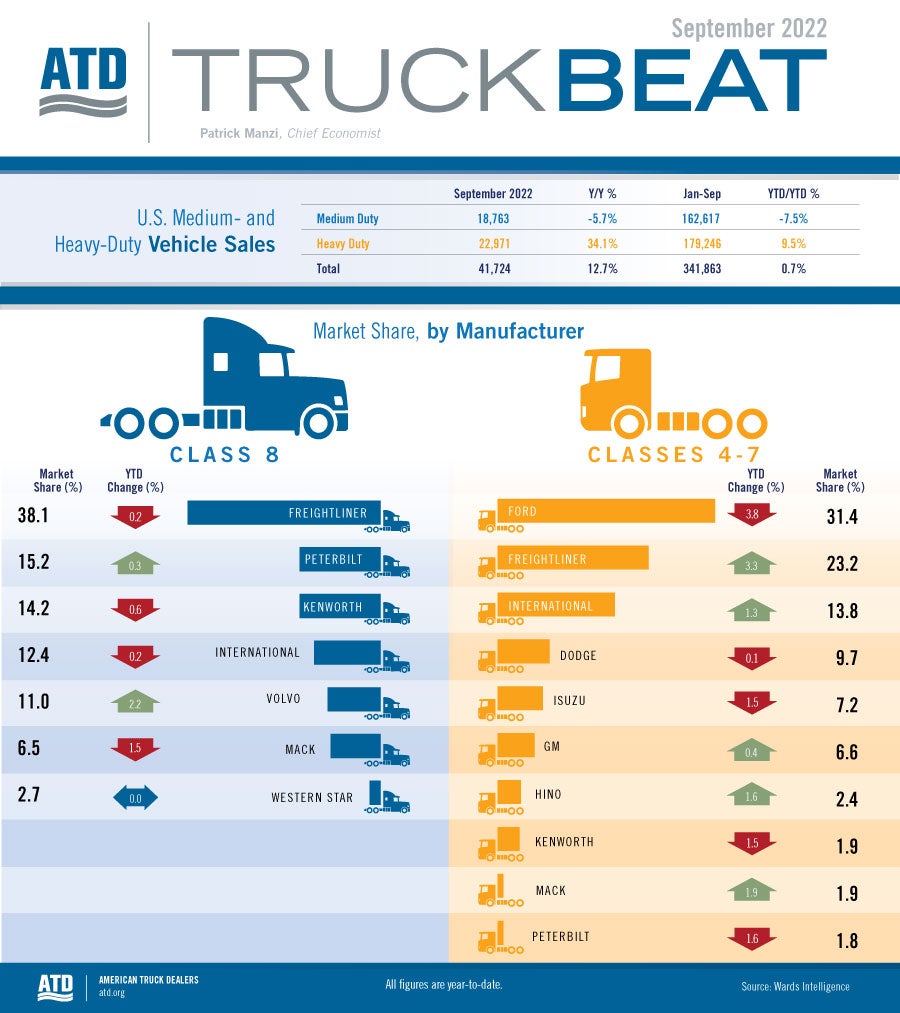

At the end of the third quarter Class 8 truck sales were up 9.5% from the same period in 2021. Sales in September 2022 had their second-best month so far this year, posting a year-over-year gain of 34.1%. The best sales month for Class 8 trucks this year was August, helping to boost total sales for the third quarter. On the other hand, sales of medium-duty trucks at the end of the third quarter were down 7.5% from the same period last year. Overall, sales for the entire commercial truck market were up only 0.7% through the first three quarters of 2022.

In September 2022 nearly all Class 8 truck OEMs opened their order books for 2023. According to ACT Research, North American Class 8 truck orders reached 53,700—an all-time high and an increase of 97.8% year over year. September 2022’s record topped the previous order record, which occurred in August. Many fleet customers have jumped in line quickly for new equipment because of the potential for production disruptions from ongoing supply chain issues. Truck makers will have to allocate trucks to customers, as fleet demands for new equipment are currently outpacing what OEMs think they can build next year.

Prices for used Class 8 trucks, while down from recent highs, were still up year over year. According to ACT Research, the average retail price for a used Class 8 truck in August was $86,732, up 28.5% year over year but down 6.4% from July 2022. The average price of a used Class 8 truck has fallen for five straight months. Used Class 8 truck prices should continue to decline through the rest of the year as demand for used heavy-duty equipment returns to a more normal level.

For all of 2022 we still expect that commercial truck sales will be higher than in 2021. We believe that medium-duty sales will total around 230,000 units and Class 8 truck sales will top 258,000.