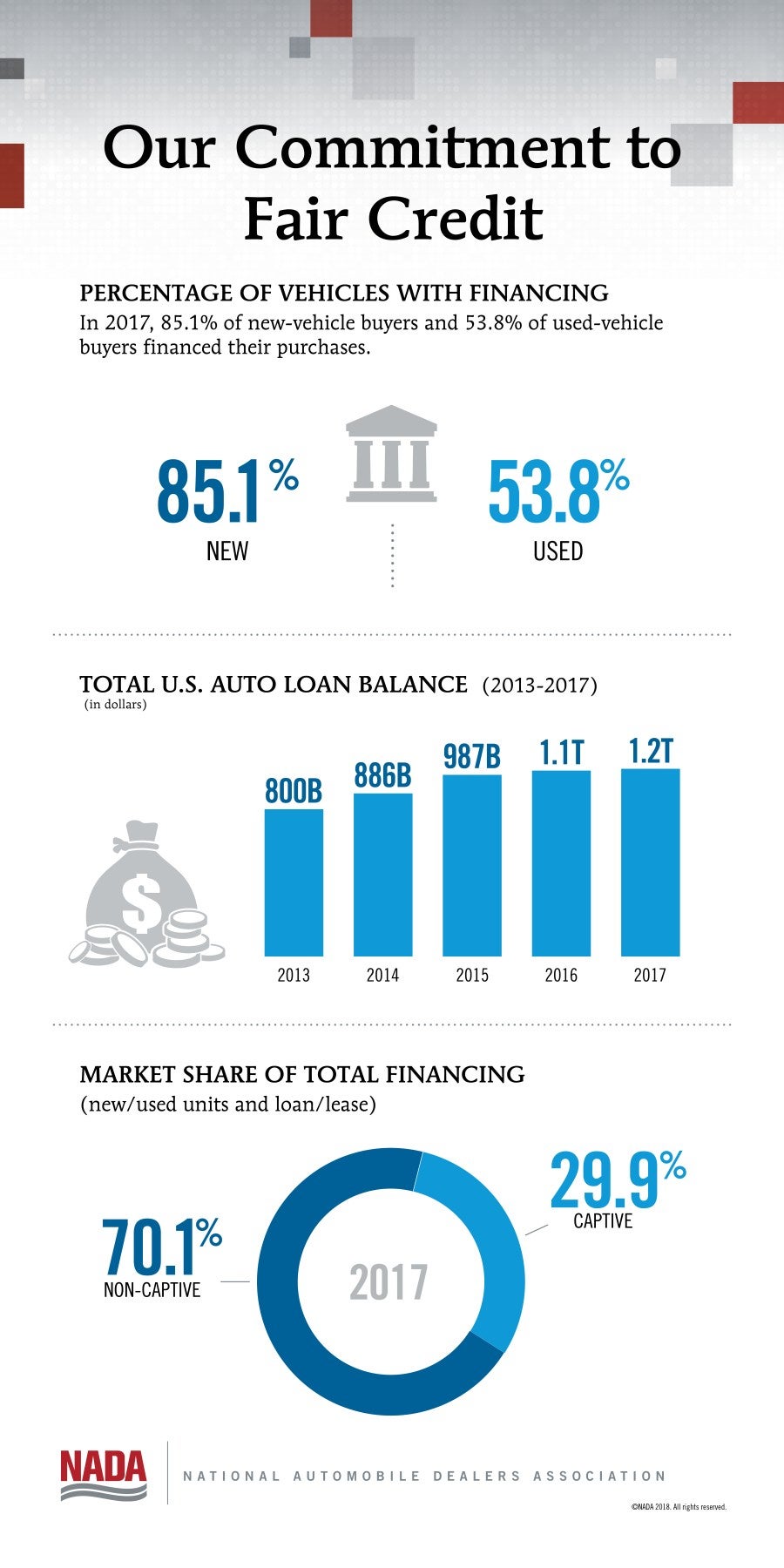

In today’s market, America’s new car and truck dealerships sell around 50,000 new cars and trucks a day. Consumer access to affordable credit at dealerships, and interest rate discounts that local dealerships can provide their customers, are keys to driving those sales. Congress recently repealed a lending guidance issued by the federal Consumer Financial Protection Bureau (CFPB) that threatened to adversely affect dealer competition and consumers’ access to interest rate discounts. The guidance was repealed because of serious agency process concerns, and because it inadequately recognized that dealerships can provide competitive credit while fully adhering to our nation’s fair credit laws. NADA is firmly committed to helping dealerships achieve both key objectives.

Adherence to non-discriminatory access to credit remains a core value for America’s new car and truck dealers. Simply put, the CFPB guidance is gone, but the anti-discrimination laws governing lending, like the Equal Credit Opportunity Act (ECOA), are not. The fair credit laws that govern dealer conduct remain part of the fabric of the law. Beyond the law, those statutes underscore a moral imperative to avoid discrimination and to treat all customers fairly and with respect.

Four and a half years ago, based on our twin commitments to competitive credit and fair lending, NADA partnered with the American International Automobile Dealers Association (AIADA) and the National Association of Minority Automobile Dealers (NAMAD) on a simple but incredibly important initiative. We sought to develop a compliance framework, available to all dealers on a voluntary basis, that enhances the ability of participating dealers to comply with our nation’s fair credit laws while retaining the flexibility needed to meet the borrowing needs of the nation’s car buyers.

Recognizing the need to promote these important goals, we re-examined a crucial question: Can fair lending compliance and consumer interest rate discounts coexist? Fortunately, the U.S. Department of Justice (DOJ), which had also been considering the issue for a long period of time, clearly determined that the answer was “yes.”

Building on that conclusion, we developed a program that promotes compliance by better structuring the exemption-based discounting system that has long been the hallmark of an ECOA-compliant indirect auto financing market. The improved approach was designed to ensure that discounting remained possible but only in ways that assured that similarly situated people were treated the same, regardless of race, national origin, religion, sex, age, or other protected characteristics.

How did we come up with this framework for maintaining fair credit compliance while preserving discounting? We didn’t—the DOJ did.

In 2007, the DOJ entered into consent orders with two dealerships to resolve allegations of fair credit violations. These allegations were remarkably similar to the more recent ones brought against indirect finance sources by the CFPB.

Importantly, these DOJ consent orders did not eliminate either dealer participation or a dealer’s ability to offer discounts. Instead, to permit consumers to continue receiving the tremendous benefits of discounting, the consent orders required the dealers to standardize the initial amount of dealer participation included in all retail installment sale contracts, and allowed deviations from that standard amount only in the presence of a legitimate business justification, such as a competing credit offer from another lender or a monthly budget constraint on the part of the customer.

It was a well-balanced and effective solution. Which is exactly why the NADA/AIADA/NAMAD Fair Credit Compliance Policy and Program (the Program) further operationalizes the DOJ framework and makes it available to all dealers. Just like the DOJ consent orders, the Program’s approach takes race and other protected characteristics out of the equation entirely; it calls for a dealer who adopts the Program to standardize the amount of dealer participation for every customer, and only allows that dealer to deviate in one direction (downward), and only in response to a legitimate business reason—like marking down a rate to meet a competing offer or monthly budget constraint—that has nothing to do with race or any non-business factor.

NADA believes the Program represents the best approach to promote compliance with ECOA while preserving enough flexibility to allow customers to continue leveraging the overwhelming benefits that are produced by today’s intensely competitive vehicle financing market. Dealerships that implement the Program reduce their discrimination liability risks under ECOA, and it is also unquestionably the right thing to do. Treating customers in a fair and consistent manner and strictly abiding by all anti-discrimination laws are central to the mission and success of franchised auto dealers everywhere. The Program reflects an unambiguous commitment to both of these principles.

For these reasons, much of our focus is on making the Program even easier to implement through partnerships with providers such as CU Direct, Dealertrack, and RouteOne. Thanks to these arrangements, the Program can easily be integrated into the F&I operations of participating dealerships, as well as automated. I am confident that we will see additional progress on this front in the coming months.

As long as I am President and CEO of NADA, I will continue to encourage every franchised dealer and dealership group to adopt and implement our Program. I will also continue to seek additional bipartisan support among federal policymakers—regardless of which party is in power—and encourage them to embrace the Program as the best way to ensure fair credit compliance in auto financing.

In the meantime, it is up to our industry to lead the way. We have at our disposal a way to affirm our commitment to abide by some of our nation’s most important laws while doing right by our customers. That’s a commitment that every dealer should be proud to get behind.

Peter Welch is President & CEO of the National Automobile Dealers Association.